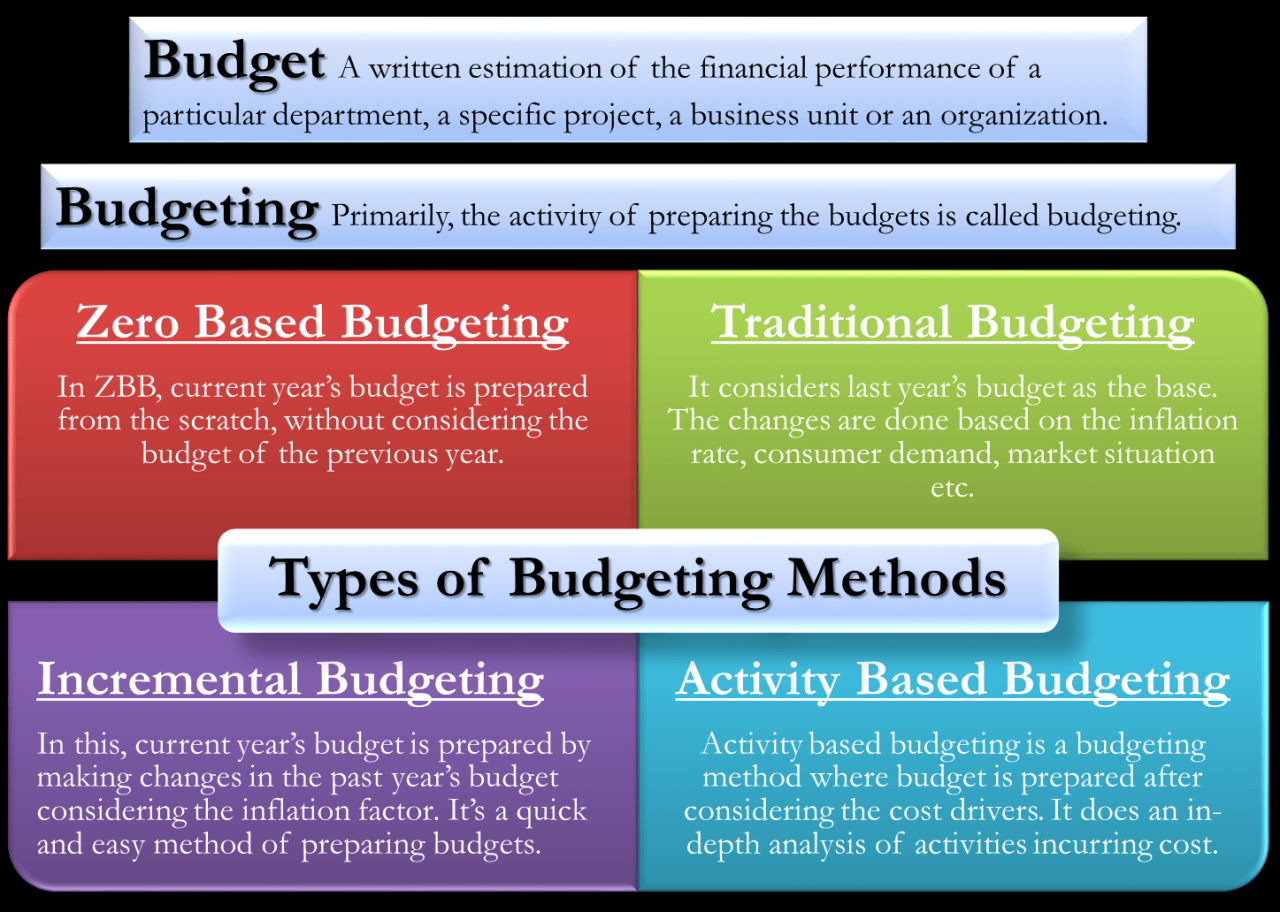

What is the proper preparation sequencing of the following budgets – Proper preparation sequencing of operating, capital, cash flow, and master budgets is crucial for organizations to effectively allocate resources, plan for future growth, and ensure financial stability. This comprehensive guide delves into the importance, steps, and integration of these budgets, providing valuable insights for businesses seeking to optimize their financial planning.

Preparation Sequence of Operating Budget

An operating budget is a financial plan that Artikels a company’s expected revenues and expenses for a specific period, typically a year. It is essential for managing cash flow, forecasting financial performance, and making informed business decisions.

Key Steps in Creating an Operating Budget

- Identify and forecast revenue streams.

- Estimate operating expenses, including salaries, rent, and utilities.

- Project depreciation and amortization.

- Calculate net income and profit margin.

- Monitor and adjust the budget as needed.

Preparation Sequence of Capital Budget

A capital budget is a financial plan that Artikels a company’s planned investments in long-term assets, such as equipment, buildings, and vehicles. It is distinct from an operating budget, which focuses on short-term financial planning.

Process of Identifying and Evaluating Capital Projects, What is the proper preparation sequencing of the following budgets

- Generate project ideas.

- Conduct feasibility studies.

- Estimate project costs and benefits.

- Analyze project risk.

- Prioritize and select projects based on profitability and strategic alignment.

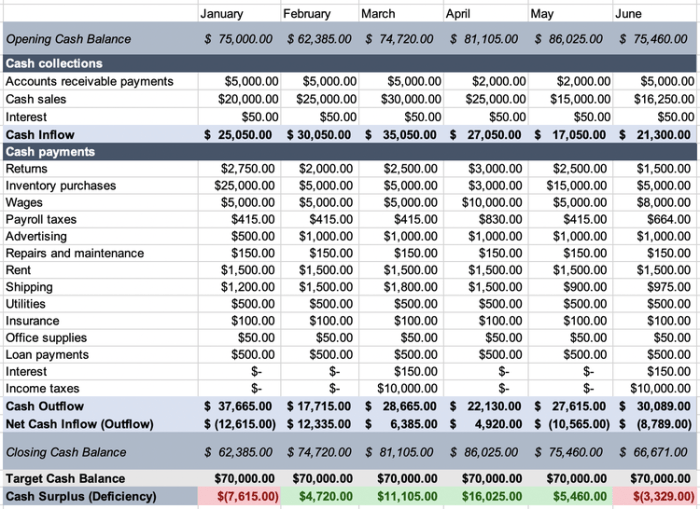

Preparation Sequence of Cash Flow Budget: What Is The Proper Preparation Sequencing Of The Following Budgets

A cash flow budget is a financial plan that tracks the inflow and outflow of cash during a specific period. It is used to ensure that a company has sufficient liquidity to meet its obligations and fund its operations.

Components of a Cash Flow Budget

- Operating activities

- Investing activities

- Financing activities

Steps in Preparing a Cash Flow Budget

- Estimate cash inflows.

- Estimate cash outflows.

- Calculate net cash flow.

- Forecast future cash balances.

- Monitor and adjust the budget as needed.

Preparation Sequence of Master Budget

A master budget is a comprehensive financial plan that coordinates the preparation of all other budgets within an organization. It ensures that all budgets are aligned with the company’s strategic goals and objectives.

Steps in Developing a Master Budget

- Develop a sales forecast.

- Prepare operating, capital, and cash flow budgets.

- Consolidate individual budgets into a master budget.

- Review and approve the master budget.

- Monitor and adjust the budget as needed.

Example of a Master Budget

| Budget | Amount |

|---|---|

| Sales budget | $1,000,000 |

| Operating budget | $500,000 |

| Capital budget | $200,000 |

| Cash flow budget | $300,000 |

Integration of Budget Preparation

Integrating the preparation of different types of budgets is essential for ensuring that a company’s financial plans are aligned and consistent. It helps to identify potential conflicts and ensure that all budgets support the company’s overall strategic goals.

Benefits of Using a Rolling Budget Approach

- Provides greater flexibility.

- Allows for more timely adjustments.

- Improves forecasting accuracy.

- Enhances communication and collaboration.

Recommendations for Effective Budget Integration

- Use a common set of assumptions.

- Establish clear communication channels.

- Involve all relevant stakeholders.

- Use a budget software to streamline the process.

- Monitor and adjust the budget regularly.

Helpful Answers

Why is it important to prepare budgets in the proper sequence?

Sequencing budgets ensures a logical flow of information, allowing organizations to build upon the foundation of previous budgets and make informed decisions based on interconnected financial data.

What are the key steps involved in preparing an operating budget?

Key steps include forecasting revenue, estimating expenses, and analyzing variances to monitor performance and make necessary adjustments.

How does a cash flow budget differ from an operating budget?

A cash flow budget focuses on the timing and flow of cash, while an operating budget tracks income and expenses over a specific period.