Dive into the world of financial reporting with our exploration of the schedule of COGM and COGS. These two schedules play a crucial role in providing insights into a company’s financial health and operational efficiency. Join us as we uncover the significance of COGM and COGS, their components, and their implications for financial analysis.

In this comprehensive guide, we will delve into the intricacies of COGM and COGS, examining their relationship, similarities, and differences. We will also explore how these schedules are used to evaluate a company’s financial performance and the disclosure requirements surrounding them.

Get ready to enhance your understanding of these essential financial statements.

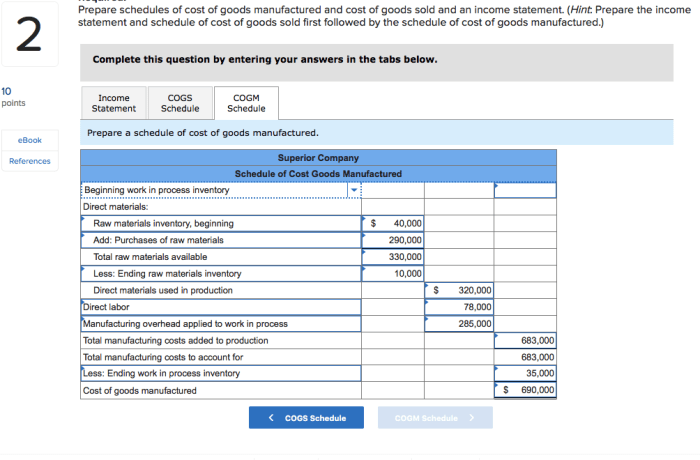

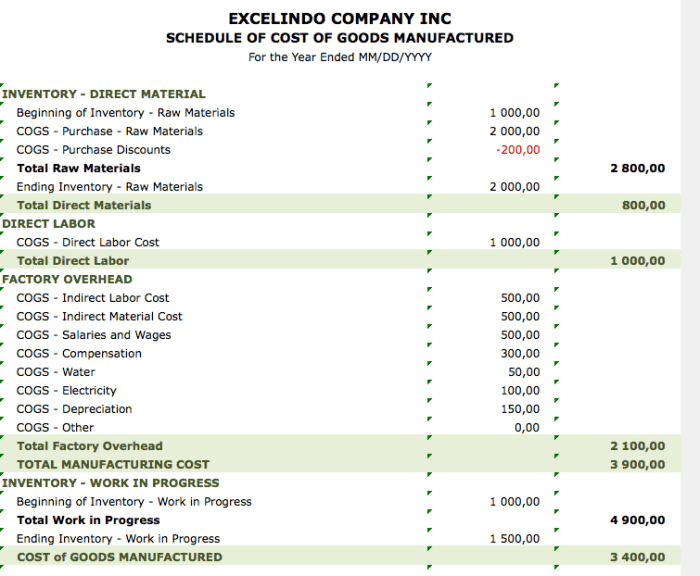

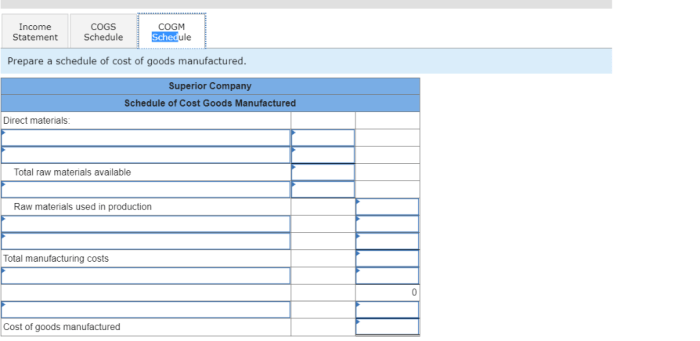

Schedule of Cost of Goods Manufactured (COGM)

The Schedule of Cost of Goods Manufactured (COGM) is a financial statement that provides a detailed breakdown of the costs incurred in producing goods during a specific period. It is an important tool for companies to understand their manufacturing costs and to make informed decisions about pricing and production levels.

COGM is calculated by adding the following costs:

- Direct material costs

- Direct labor costs

- Manufacturing overhead costs

Direct material costs are the costs of the raw materials used in the production of goods. Direct labor costs are the wages and benefits paid to workers who are directly involved in the production process. Manufacturing overhead costs are all other costs incurred in the production process, such as rent, utilities, and depreciation on equipment.

The Schedule of COGM can be used to allocate overhead costs to specific products. This is important for companies to understand the profitability of each product and to make decisions about which products to produce.

Methods of Allocating Overhead Costs

There are a number of different methods that can be used to allocate overhead costs to COGM. The most common methods are:

- Activity-based costing

- Direct costing

- Variable costing

Activity-based costing is the most accurate method of allocating overhead costs, but it can also be the most complex. Direct costing is a simpler method that can be used when the overhead costs are relatively small. Variable costing is a method that only allocates variable overhead costs to COGM.

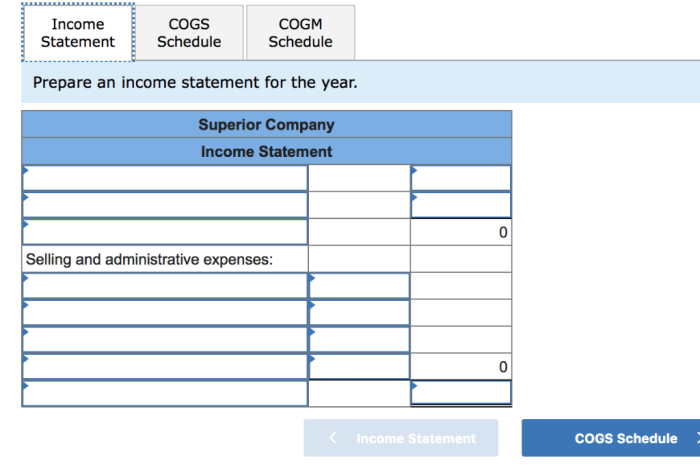

Schedule of Cost of Goods Sold (COGS)

The Schedule of Cost of Goods Sold (COGS) is a financial statement that summarizes the direct costs incurred in producing the goods sold by a company during a specific period. COGS is closely related to the Schedule of Cost of Goods Manufactured (COGM), as it represents the portion of COGM that has been sold to customers.

COGS is calculated by adding the beginning inventory to the cost of goods manufactured and then subtracting the ending inventory. The resulting figure represents the total cost of the goods that have been sold during the period.

Components of COGS

The components of COGS include:

- Direct materials: The cost of the raw materials used in the production of the goods.

- Direct labor: The wages paid to the workers who produce the goods.

- Manufacturing overhead: The indirect costs incurred in the production of the goods, such as rent, utilities, and depreciation.

Methods for Determining Ending Inventory Value

There are several methods that can be used to determine the ending inventory value. The most common methods include:

- First-in, first-out (FIFO): This method assumes that the oldest inventory is sold first. As a result, the ending inventory value is based on the cost of the most recently purchased goods.

- Last-in, first-out (LIFO): This method assumes that the newest inventory is sold first. As a result, the ending inventory value is based on the cost of the oldest purchased goods.

- Weighted average: This method assumes that the cost of the ending inventory is equal to the average cost of all the goods that were available for sale during the period.

Comparison of COGM and COGS: Schedule Of Cogm And Cogs

The Schedules of Cost of Goods Manufactured (COGM) and Cost of Goods Sold (COGS) are both financial statements that provide information about the costs associated with producing and selling goods. However, there are some key differences between the two schedules.

Key Features, Schedule of cogm and cogs

| Feature | COGM | COGS |

|---|---|---|

| Period Covered | Manufacturing period | Selling period |

| Costs Included | Direct materials, direct labor, and manufacturing overhead | COGM plus selling and administrative expenses |

| Purpose | To determine the cost of goods produced during a period | To determine the cost of goods sold during a period |

As you can see from the table, COGM and COGS are similar in that they both include the costs of direct materials and direct labor. However, COGM also includes manufacturing overhead costs, while COGS includes selling and administrative expenses. This is because COGM is used to determine the cost of goods produced during a period, while COGS is used to determine the cost of goods sold during a period.

It is important to understand the differences between COGM and COGS because they can have a significant impact on a company’s financial statements. For example, a company with a high COGM but a low COGS may be able to increase its profit margin by reducing its manufacturing costs.

Conversely, a company with a low COGM but a high COGS may be able to increase its profit margin by reducing its selling and administrative expenses.

While studying the schedule of cost of goods manufactured (COGM) and cost of goods sold (COGS) can be important for business students, expanding knowledge in other areas like ap human geo unit 3 vocab can also be beneficial. Understanding COGM and COGS can help businesses track their expenses and make informed decisions, but exploring other concepts like population density and urbanization in the ap human geo unit 3 vocab can broaden one’s understanding of the world around them.

Use of COGM and COGS in Financial Analysis

COGM and COGS are key metrics used in financial analysis to assess a company’s profitability and operational efficiency. They provide valuable insights into the company’s production costs and inventory management practices.

Financial analysts utilize COGM and COGS to calculate various ratios and metrics that help evaluate a company’s financial performance. These include:

Gross Profit Margin

- Measures the percentage of revenue left after deducting COGS.

- Indicates the company’s pricing power and cost control.

- A higher gross profit margin suggests better cost management and profitability.

Inventory Turnover

- Calculates how many times a company sells and replaces its inventory during a period.

- Assesses the efficiency of inventory management and the company’s ability to meet customer demand.

- A higher inventory turnover indicates efficient inventory management and lower holding costs.

Days Sales Outstanding (DSO)

- Measures the average number of days it takes a company to collect its accounts receivable.

- Provides insights into the company’s credit policies and customer payment practices.

- A shorter DSO indicates effective credit management and reduced risk of bad debts.

By analyzing COGM and COGS, financial analysts can identify trends, assess the company’s financial health, and make informed investment decisions.

Disclosure Requirements for COGM and COGS

Financial statements must disclose COGM and COGS to provide transparency and accountability in financial reporting.

These disclosures help users understand the company’s production and sales activities, enabling them to assess its profitability and financial performance.

Disclosure in Financial Statements

- Income Statement:COGM and COGS are typically disclosed in the income statement, under the heading “Cost of Goods Sold” or “Cost and Expenses.”

- Notes to Financial Statements:Additional details about COGM and COGS, such as inventory valuation methods and allocation of overhead costs, are often provided in the notes to financial statements.

Question & Answer Hub

What is the difference between COGM and COGS?

COGM (Cost of Goods Manufactured) represents the total cost incurred in producing goods during a specific period, while COGS (Cost of Goods Sold) represents the cost of goods sold during that period. COGM includes the cost of direct materials, direct labor, and manufacturing overhead, whereas COGS additionally includes the cost of beginning inventory.

How are COGM and COGS used in financial analysis?

COGM and COGS are key components in calculating various financial ratios, such as gross profit margin, inventory turnover ratio, and days sales outstanding. These ratios provide insights into a company’s profitability, efficiency, and liquidity.

What are the disclosure requirements for COGM and COGS?

According to GAAP and IFRS, companies are required to disclose COGM and COGS separately in their financial statements. This disclosure provides transparency and enables investors and analysts to assess the company’s cost structure and financial performance.